Email Us:

Call Licensed agent

Email Us:

Call Licensed agent

Ready for Reliable Retirement Income?

Discover the Benefits of Annuities

Envisioning Your Golden Years?

Review Your Retirement Portfolio and Goals

Share your retirement needs and aspirations with us, and discover how we can assist you in achieving them

Evaluating Your Financial Plan

Get a second opinion on your retirement strategy to ensure you're on the right track.

Explore Annuity Options

Discover the different types of annuities and find out if they’re the right fit for you

An Annuity is a financial product offered by insurance companies, designed to provide a steady source of retirement income with minimal risk. When you purchase an annuity, you deposit a significant sum with the insurer, who then invests it on your behalf. After an accumulation period, where your money is held and invested, the insurer begins making regular payments to you. While this process may seem straightforward, annuity contracts can be complex and challenging to fully understand.

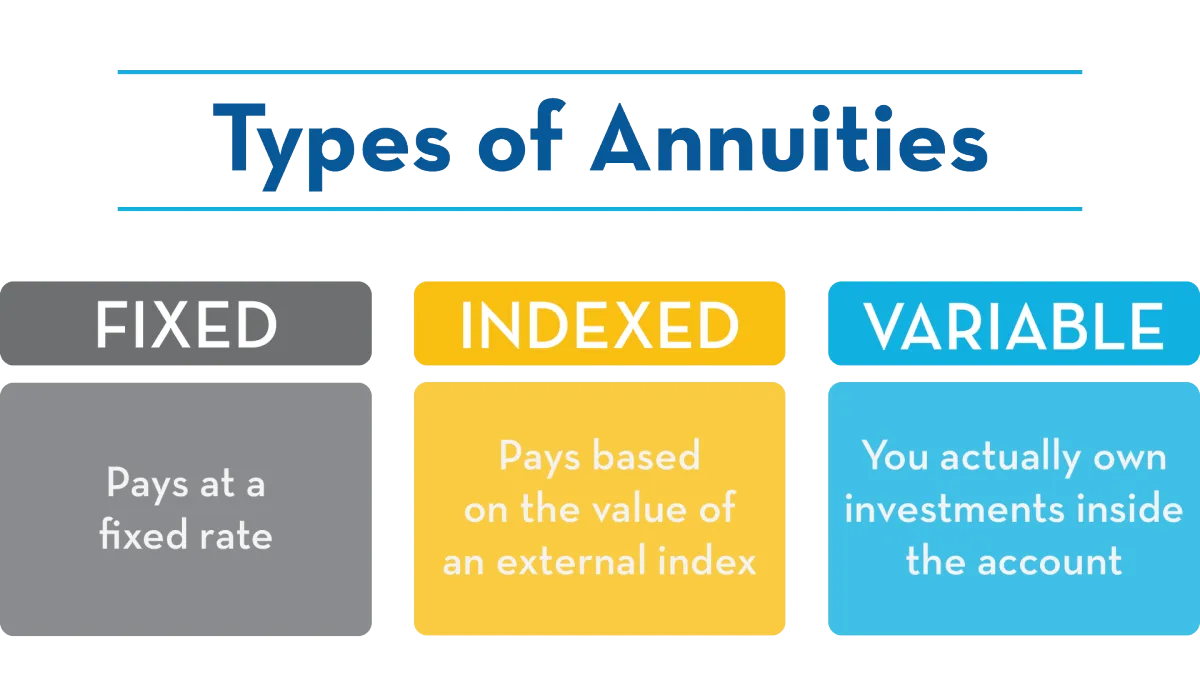

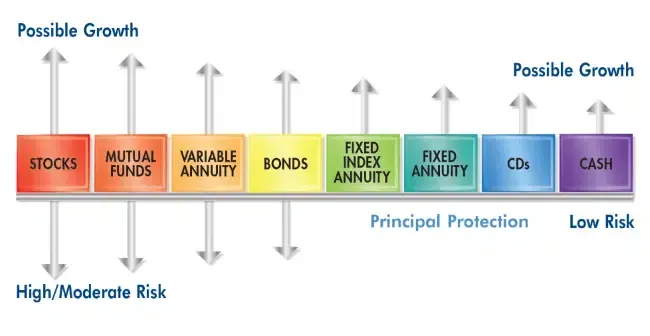

There are various types of annuities, each with its own benefits and drawbacks. The simplest is a fixed annuity, which offers a guaranteed, though typically lower, rate of return. On the other hand, variable annuities invest your money in the stock market through sub-accounts, potentially yielding higher returns but with greater risk. Other types of annuities exist, each tailored to different financial goals and risk tolerances.

Why Working With a Broker is Better!

Working with a broker like G2 | Agency when buying an annuity offers significant advantages that can help you make a more informed and confident decision. G2 | Agency brokers have access to a wide range of annuity products from multiple insurance companies, allowing them to compare options and find the best fit for your unique financial situation and retirement goals. Unlike agents who may be tied to a single provider, brokers work on your behalf, providing unbiased advice and ensuring you understand the complexities of each option. Their expertise can help you navigate the intricate details of annuity contracts, maximize your potential returns, and avoid costly pitfalls, ultimately giving you peace of mind and greater financial security in retirement.

The primary benefit of an annuity is the regular payments you receive, offering a stable income stream. Additionally, annuities are generally less risky than investing in the stock market, which can appeal to more conservative investors. However, annuities typically don’t offer the same growth potential as other investments. They often come with significant fees, including annual administration costs and commissions paid to the adviser who sells the annuity. Another drawback is that annuities can lock up your money for the long term—if you need access to funds in an emergency, you may face penalties for early withdrawal.

We know that buying an annuity is important to you and could be the biggest decision of your retirement. Get all the information you need right now to make an informed decision.

Pays off your mortgage in the event of death, disability, or critical illness. It ensures your family can stay in your home without financial strain, providing a targeted benefit that decreases with your mortgage balance, offering peace of mind and security

They provide guaranteed minimum returns linked to a stock market index, combining growth potential with stability. This ensures steady income and peace of mind for retirees.

These annuities can offer growth, but it's important to know what you're buying.

Term Life Insurance provides affordable coverage for a set period, paying a death benefit if the policyholder passes away during the term. It's a cost-effective way to protect loved ones and secure financial stability.

Covers funeral and burial costs, offering a simple and affordable way to ease financial burdens on loved ones. It ensures that end-of-life expenses are covered, providing peace of mind and financial protection.

Insurance that provides income protection if you're unable to work due to illness or injury. It replaces a portion of your income, helping you maintain financial stability and cover essential expenses during recovery.

Offers financial support if you're diagnosed with a severe illness, such as cancer or heart disease. It provides a lump-sum payment to cover medical expenses and living costs, easing the financial burden during a challenging time.

Ensures a stable income during retirement by safeguarding your savings from market volatility and unexpected expenses. It helps maintain financial security and provides peace of mind, allowing you to enjoy your retirement without financial worries.

Provides early financial protection for children, offering benefits like savings for future education and coverage for unexpected health issues. It’s designed to give families peace of mind and secure a financial foundation for their child's future.

Promotes strategies focus on eliminating debt and building financial security. By managing and reducing debt, you can achieve financial freedom, enhance your savings, and create a more stable and stress-free financial future.

Todd Gorman

CA License # 0C72954

National Producer #3146641

4883-B Ronson CT, San Diego, CA 92111

G2 | Agency ©2025

Not affiliated with the U. S. government or federal Medicare program.

We do not offer every plan available in your area. Any information we

provide is limited to those plans we do offer in your area.

Please contact

to get information on all of your options. ( TTY 1-877-486-2048 )

Jane Doe

Satisfied Customer

Jane Doe

Satisfied Customer

Jane Doe

Satisfied Customer

Jane Doe

Satisfied Customer